BAcc Hons

CA(SA)

Izak brings over 15 years of financial services experience to his role as Portfolio Manager at Mergence. He co-managed portfolios from November 2019 to December 2022, having joined the team in 2011 as an equity research analyst and dealer. His current focus encompasses resources, beverages, luxury goods, and healthcare. His background extends to being an investment committee member in private markets and an audit manager at PwC prior to joining Mergence.

Lesana is the largest licensed non-deposit-taking microfinance institution in Lesotho, specialising in serving government employees with loans for incremental housing, solar power units, water provision, insurance, and retail credit. With nine branches across Lesotho, it’s a vital support system for the community’s financial needs.

Sanlei is a trout farm located at Katse and Mohale dams with 5000 MT licenses. Sanlei exports sushi-grade trout to customers in Japan, South Africa, and the USA. It employs over 80 permanent staff and is the only BAP-certified aquaculture farm on the African continent.

Thusong is a majority-Basotho-owned payroll-based lender, focused on transformational products for civil service clientele. Despite originally being a family-owned business, Thusong is now the country’s third largest microfinancier, with plans to further expand regionally. It currently operates three branches.

Maluti Green Med is a vertically integrated licensed cannabis cultivator that operates on a 3500-acre farm. Its product range includes organic flowers, biomass, and brokerage THC. MGM is GACP accredited and is currently working towards obtaining a EU-GMP certification, with the facility already under construction.

MG Health is the sole cannabis grower in Lesotho with GMP certification. It produces medical cannabis flowers and extracts (cannabinoid oils as creams, ingestible and capsules). Committed to improving the lives of Basotho, MGM has created over 250 jobs.

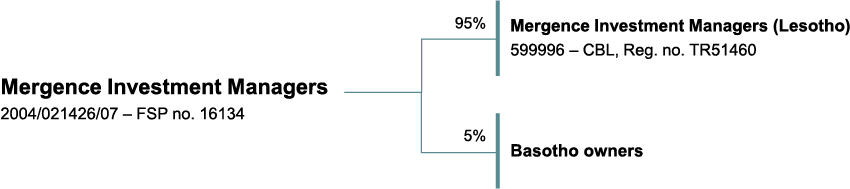

Mergence Investment Managers (Lesotho)

Mergence Investment Managers (Lesotho) (“Mergence Lesotho”) is a licenced investment manager registered and regulated by the Central Bank of Lesotho. The company forms part of the South African specialist black-owned asset manager, Mergence Investment Managers (Pty) Ltd., which has been in existence since 2004.

Financial Advice

Mergence does not provide financial advice. All information on this website is for general informational purposes only and should not be construed as advice. Users seeking financial or investment advice should consult an independent financial adviser.

Content

The information provided on this website is general and does not guarantee the suitability or potential value of any investment. Users are responsible for evaluating the appropriateness of investments based on personal objectives, financial circumstances, and risk tolerance. The content does not constitute a solicitation, recommendation, endorsement, or offer by Mergence.

Ownership and copyright

The information and content on this website are owned by Mergence and protected by copyright. Users may not reproduce, distribute, or modify the content without explicit permission from Mergence.

You are solely responsible for assessing the suitability of any investment, strategy, security, or transaction based on your personal objectives, financial situation, and risk tolerance. Consult an independent financial adviser for personalised advice. The information provided here is not a solicitation, recommendation, or offer by Mergence, but an invitation to do business.

Email Legal Notice

Refer to our email legal notice for additional information.

Privacy Policy

Details about our privacy policy can be found here.

Complaints Procedure

Details about our complaint procedure can be found here.

Conflict of Interest Management Policy

Details about our conflict-of-interest management policy can be found here.

Important Information

The content and information on this website are provided “as is” and “as available.” While Mergence strives for accuracy, it does not warrant error-free, accurate, or reliable information. Mergence disclaims liability for any loss, damage, or expense resulting from the use or reliance on the information provided on this website. While Mergence has taken steps to ensure the website’s integrity, including its content and information, no explicit or implied warranty is given regarding the information or services. Legal implied warranties are excluded, except where prohibited by law. Mergence reserves the right to suspend, terminate, or modify this website, email services, or these terms of use without notice. Users are deemed to accept changes by continuing to use the website after modifications.

Governing Law

The content contained on this website will be interpreted and implemented in accordance with the laws of Lesotho.

Email Legal information for Mergence Lesotho

Your use of our email services, including receiving fact sheets, minimum disclosure documents, periodic reports, and price/performance information via email, is subject to your acceptance and compliance with our terms of use. By using our website or email services, you agree to all our terms.

Licensed Investment Manager under Central Bank Regulation

Mergence Investment Managers (Lesotho) (“Mergence Lesotho”) is a licenced investment manager registered and regulated by the Central Bank of Lesotho. The company forms part of the South African specialist black-owned asset manager, Mergence Investment Managers (Pty) Ltd., which has been in existence since 2004.

Confidentiality Notice

The information in this email and any attached documents is confidential and may be legally privileged and subject to client confidentiality. Unauthorized use by anyone other than the intended recipient is strictly prohibited. If you receive this email in error, please notify the sender immediately and delete it from your system. Do not copy, disclose, or use the contents without explicit written consent from Mergence Lesotho.

Ownership and Copyright

The contents are owned by Mergence Lesotho and protected by copyright and intellectual property laws. Unauthorized reproduction, distribution, publication, or exploitation is prohibited. You are authorized to view, download, print, and distribute the content for non-commercial, private use only, subject to Mergence’s terms. Incorporating proprietary material into other works requires prior written permission.

Electronic Communications

By communicating electronically with Mergence Lesotho, you consent to receiving electronic communications. Emails are considered received only upon confirmation by Mergence, and they are considered sent once reflected as ‘sent’ on Mergence’s email server.

Important Information

Mergence Lesotho strives for accuracy but does not guarantee error-free content. It disclaims liability for any loss, damage, or expense resulting from the use or reliance on information, links, or services provided. Mergence is not responsible for viruses and disclaims liability for non-delivery or incorrect delivery of email contents.

No Warranties

Mergence Lesotho makes no implied warranties, excluding any implied by law to the extent allowed by law.

Termination and Modifications

Mergence Lesotho reserves the right to suspend, terminate, or modify email services and terms of use without notice. Continued use implies acceptance of changes.

Personal Use by Employees

Users using Mergence Lesotho’s email system for personal purposes do so at their own risk. Mergence does not distinguish between business and personal emails.

Interception and Monitoring

Mergence Lesotho reserves the right to intercept and monitor communications for lawful purposes, performed by authorised representatives.

Offer

This email is not a solicitation, recommendation, endorsement, or offer by Mergence Lesotho. It is an invitation to do business.

Governing Law

This email and attached documents will be interpreted and implemented according to Lesotho Laws.

Mergence, in addition to our South African and Namibian private market funds, operates a private equity fund in Lesotho. Our investments in local opportunities aim to achieve high developmental returns alongside attractive capital gains, reflecting our belief that a sustainability-focused business is a good business. Our investment mandate is broad, encompassing many potential sectors. Currently, we are invested in the following sectors:

Healthcare

Micro-finance

Food security

Energy

Education

Aqua-Culture

Infrastructure

Lesana is the largest licensed non-deposit-taking microfinance institution in Lesotho, specialising in serving government employees with loans for incremental housing, solar power units, water provision, insurance, and retail credit. With nine branches across Lesotho, it’s a vital support system for the community’s financial needs.

Sanlei is a trout farm located at Katse and Mohale dams with 5000 MT licenses. Sanlei exports sushi-grade trout to customers in Japan, South Africa, and the USA. It employs over 80 permanent staff and is the only BAP-certified aquaculture farm on the African continent.

Location: Maseru, Lesotho

Thusong is a majority-Basotho-owned payroll-based lender, focused on transformational products for civil service clientele. Despite originally being a family-owned business, Thusong is now the country’s third largest microfinancier, with plans to further expand regionally. It currently operates three branches.

Maluti Green Med is a vertically integrated licensed cannabis cultivator that operates on a 3500-acre farm. Its product range includes organic flowers, biomass, and brokerage THC. MGM is GACP accredited and is currently working towards obtaining a EU-GMP certification, with the facility already under construction.

MG Health is the sole cannabis grower in Lesotho with GMP certification. It produces medical cannabis flowers and extracts (cannabinoid oils as creams, ingestible and capsules). Committed to improving the lives of Basotho, MGM has created over 250 jobs.

The Mergence Prime CPI + 4% Fund is managed with the objective of producing a real return of CPI plus 4% per annum over the longer term while preserving capital over a rolling 12-month period. It may underperform relative to overall equity markets due to its focus on capital preservation and long-term capital growth. This portfolio has relatively low equity exposure, resulting in relatively low volatility compared to higher-risk portfolios. The portfolio is exposed to default and interest rate risks. Therefore, this fund is suitable for investors with medium-term investment horizons.

The objective of the Mergence Equity Prime Fund is to achieve returns that are greater than the FTSE/JSE Capped Shareholder Weighted Index (Capped SWIX) over any three-year rolling period without exposing the Fund to excessive risk. This portfolio has a higher exposure to equities than any other risk-profiled portfolio and therefore tends to carry higher volatility due to its high exposure to equity markets. The Fund is suitable for investors who seek specialist South African equity exposure as part of their overall investment strategy, believe long-term equity exposure adds value, and understand the nature of equity exposure in that there is a risk of market fluctuations.

Mergence offers a specialised selection of traditional fixed-income solutions, supported by a rigorous investment approach. Our product suite is crafted to provide substantial interest income with minimal risk of capital erosion, offering dynamic returns tailored to various risk appetites, and crucial diversification precisely when needed. The Mergence Prime Money Market Fund is structured to consistently outperform its benchmark performance over a rolling 12-month period, prioritising liquidity with a low-risk profile. This extensively diversified portfolio strategically incorporates a variety of South African money market instruments.

BCom (Accounting)

BCom Hons (Financial Planning)

MBA (Strategy)

CFP®

General Tax Professional (GTP-SA)

Semoli joined Mergence in 2017 as a regional investment strategist. He has 20 years’ experience, including as a fund accountant, investment consultant, and business development executive. With a strong network of contacts throughout the Southern African Development Community (SADC), he is also a non-executive director on several company boards. Semoli also serves on the executive committee of Mergence Investment Managers.

Lesotho Diploma (Office Admin), BTech (Marketing)

Papali joined Mergence Investment Managers (Lesotho) in 2018 as an Office Administrator and in 2019, she was promoted to a position in business development. Papali responsible for generating local and regional leads, building, and managing client relationships, and managing office compliance requirements. She previously worked as an employee benefits administrator for NBC Lesotho and as a marketer at the Lesotho Electricity Company.

BSc Hons, MCom (Financial Management), ACCA

Chito joined Mergence in 2011 as an equity analyst in the public markets’ investment team focused on FMCG, hospitality, financial services, and telecommunications before transitioning to the private markets investment team in 2015. As Investment Principal, Chito focuses on private market investment opportunities within SADC. He has led transactions in the aquaculture and microfinance sectors and serves on the boards of several investment companies.

BBusSci Hons

Tshepiso joined Mergence in Johannesburg in 2018 following 11 years of experience in the deal team of a private equity house. At Mergence, Tshepiso has worked on deals in medicinal cannabis, primary healthcare, affordable housing, agri-finance, specialised healthcare, waste management, secondary mining, student accommodation, financial inclusion, and fintech spaces.

BA (Economics), PGD (Property Management & Development), MBA (Finance)

Ntsebeng joined Mergence Investment Managers (Lesotho) as a property analyst in 2022. She has six years of experience, including time spent as a real estate specialist and data analyst. Her responsibilities at Mergence include analysing the economic drivers of the commercial property portfolio and assessing the financial opportunity for existing and potential property investments.

BCom (Investment Management and Banking), BCom Hons

Linkeng joined Mergence Investment Managers (Lesotho) in 2022 as a trainee analyst, where she supports the investment analyst team within private markets. Her role encompasses assisting with the origination of opportunities and guiding them through the investment process to implementation. Linkeng has team leadership skills, having been an SRC exco member at university.

BCom (Financial Accounting), PGDA, CA(SA)

Nandipha joined Mergence as a risk manager in the Private Markets investment team in June 2017. She has six years of experience working as an external and internal investment auditor. Nandipha’s responsibilities at Mergence include ensuring that governance, risk, and control frameworks are effective and that all investment activities, across all markets, sectors, and deals, are in accordance with applicable legislation, regulation, and client mandates.

Mergence embraces the multi-culturalism and multi-racial diversity of Southern Africa, and we are building businesses that reflect this. We are committed to building a better future for our communities, children, environment and our country.

We are building and uplifting our communities to help ensure they are healthy, educated, and cared for.

The following project, among others, forms part of Mergence’s corporate social investment in Lesotho.

The LNLVIP’s mandate is to promote, protect and advocate for recognition and inclusion of the needs and rights of the visually impaired into all public services.

LNLVIP is eradicating poverty amongst the Visually Impaired Persons, one of the key factors that people with disability face is poverty due to more reasons that cause barriers for them to end up not being improved economically. Therefore LNLVIP has embarked with journey to empower men and women with visual impairment economically by providing them with capital to start their own businesses after being skilled trained with what they can do for their self-employment.

Administration

At Mergence, we focus on our core competency, which is fund management. As such, our fund administration is outsourced to an independent service provider, Maitland Fund Services.

Backup and Disaster Recovery Plan (DRP)

Our data and email systems are fully cloud-based, secured, and redundantly stored. Testing occurs periodically to ensure that a full backup is readily available. Our DRP ensures that we will be able to continue operating in the event of a disaster while we re-establish and set up a physical office.

Conflict of Interest

Our document titled Conflicts of Interest Policy and Conflict Management Framework outlines the conflicts of interest and conflict management policies adopted by Mergence and its employees, key individuals, and representatives. A copy of this document is available on request.

Complaint Handling Procedure

Mergence Lesotho has systems in place for the purpose of timely and efficient resolution of complaints within the specified timeframes. Our complaint handling procedure is documented and available on request.

Global Investment Performance Standards (GIPS)

These standards govern the preparation and presentation of performance numbers, and although compliance with them is voluntary, Mergence adopts the standards as they are considered best practice.

Regulation and Compliance

Legal compliance is also outsourced. Ongoing external compliance is outsourced to Compli-Serve SA. Compli-Serve SA is a leading independent specialist provider of advisory and operational compliance services to the financial services sector. Internally, the compliance administrator is accountable for compliance. Regular communication with the Central Bank of Lesotho ensures that Mergence is up to date with the latest regulatory changes and complies with the necessary requirements.

Our clients comprise institutional pension funds, government agencies, fund of funds managers, multi-managers, and individuals within SADC. In providing investment management services to our clients, we:

INSTITUTIONAL CLIENTS:

Our focus is on unlisted businesses and projects where our experience in the private equity and impact arenas, together with our specialised skill set, enable us to execute unlisted investments successfully.

Local retirement funds have an increased need to repatriate funds back into the country, and Lesotho has many local projects requiring funding in the areas of energy, transport, water, health, and telecommunications. Specialised fund managers such as Mergence Lesotho play an important role in providing debt and/or equity funding to projects as well as playing a pivotal role in implementing public-private partnerships between government and the private sector.

INDIVIDUAL CLIENTS:

We currently have three unit trusts available to individual investors.

Mergence CPI +4% Prime Fund (Unit Trust)

The Mergence Absolute Prime Fund is a South African multi-asset fund aiming to produce a real return of CPI plus 4% per annum over the longer term while preserving capital over a rolling 12-month period.

Mergence Equity Prime Fund

This is a fund seeking specialist South African equity exposure with the objective of achieving returns above the FTSE/JSE Capped Shareholder Weighted Index (Capped SWIX) over any three-year rolling period without exposing the fund to excessive risk.

Mergence Money Market Prime Fund

The Mergence Money Market Prime Fund is a secure and liquid investment option. It focuses on capital preservation while offering competitive returns aligned with short-term money market rates. Ideal for those who prioritize safety and easy access to funds. We offer a range of local and offshore investment strategies that meet the needs of retirement funds and individuals in Southern and Sub-Saharan Africa. We are dedicated to managing and growing our clients’ investments in a socially sustainable manner. Our clients are mainly institutional investors with a growing range of retail investors.

Integrity and honesty

Excellence

Entrepreneurial Spirit

Growth and innovation

Fiduciaries

Transformation

It is our longstanding belief that companies cannot achieve sustainable economic success while neglecting their social and environmental responsibilities. Responsible investing forms an intrinsic part of our investment processes and supports our mission in creating sustainable shared value through delivering positive risk-adjusted returns for our clients while making a significant positive impact on society and the environment.

Engagement with companies and voting at shareholder meetings are both powerful tools that we have considered to be an essential part of our active management offering since the very beginning of our responsible investing journey. We were one of the first South African asset managers to make public its proxy voting decisions. Click here to view our historic proxy voting records.

CLICK HERE to view our historic proxy voting records.

We have been early supporters of initiatives guiding responsible investing, including:

Our investment processes deliberately include ESG considerations which are continually refined, updated and enhanced by the investment teams.

Our Public Markets team have an explicit ESG pillar and minimum ESG deliverables as part of their equity research process and portfolio construction. Similarly, the Private Markets team have an ESG management system which details how they incorporate ESG issues into the investment decision-making process with a view to mitigating overall portfolio risk, promoting sustainability, and generating positive impact. The system also spells out our ESG requirements of investee companies.

At Mergence, we believe in the power of People, Planet and Prosperity, acknowledging that making profits can only be justified if people and the planet are respected and preserved in the process. Our ethos of creating sustainable shared value is at the heart of our business. Making a positive impact on society, embracing diversity and inclusion, nurturing relationships, and encouraging an entrepreneurial spirit underpin our commitment to being a responsible employer.

As evaluated by an independent agency we currently hold a Level 1 BBBEE rating.

We offer a range of local and offshore investment strategies that meet the needs of retirement funds and individuals in Southern and Sub-Saharan Africa. We are dedicated to managing and growing our clients’ investments in a socially sustainable manner. Our clients are mainly institutional investors with a growing offering of retail investors.

Mergence was a pioneer in impact and infrastructure investing, with a rich history showcasing the advantages of uncorrelated alternative investments. We strongly advocate for the potential of these investments to deliver consistent long-term returns while making a positive social impact. Our diverse portfolio encompasses a wide range of debt and equity asset classes carefully chosen from sectors that global and national organisations have identified as high-priority areas.

This Fund aims to invest in a diversified combination of infrastructure risk-adjusted returns, whilst supporting the development of both social and economic infrastructure services. The Fund forms part of the Mergence suite of impact funds. The Fund strives to generate attractive risk-adjusted returns over that of the FTSE/JSE All Bond Index (ALBI).

The Mergence Infrastructure & Development | Debt Fund has a long-term performance target of inflation +3% per annum over the medium to long term by investing in opportunities that create both a positive and measurable social, developmental, and/or environmental impact.

Our specialist equity mandates aim to provide investors with capital growth over the long term. The key objective of these mandates is to consistently achieve returns that are in excess of the respective benchmarks over any rolling three-year period, without exposing the client to excessive risk. We embrace a style-agnostic approach and have a strong bias towards quality at a reasonable price.

The objective of these Funds is to provide commercially viable investments into the renewable energy sector enabling investors to achieve targeted investment returns together with social and environmental impact. Through both these Funds, we are invested in 13 renewable energy projects within Southern Africa, across both wind and solar. Fund II is open for investment.

This Fund aims to invest in a diversified combination of infrastructure risk-adjusted returns, whilst supporting the development of both social and economic infrastructure services. The Fund forms part of the Mergence suite of impact funds. The Fund strives to generate attractive risk-adjusted returns over that of the FTSE/JSE All Bond Index (ALBI).

Our specialist equity mandates aim to provide investors with capital growth over the long term. The key objective of these mandates is to consistently achieve returns that are in excess of the respective benchmarks over any rolling three-year period, without exposing the client to excessive risk. We embrace a style-agnostic approach and have a strong bias towards quality at a reasonable price.

The objective of these mandates is to achieve returns that are in excess of the FTSE/JSE Capped Shareholder Weighted Index (Capped SWIX) over any three-year rolling period without exposing the Fund to excessive risk. These core mandates target maximum active returns relative to tracking error volatility.

The Mergence Equity Prime Fund is a collective investment scheme fund that aims to provide investors with capital growth over the long term by achieving returns that are in excess of the FTSE/JSE Capped Shareholder Weighted Index (Capped SWIX), without exposing the Fund to excessive risk.

The objective of these mandates is to achieve returns that are in excess of the FTSE/JSE Shareholder Weighted Index (SWIX) over any three-year rolling period without exposing the Fund to excessive risk. These core mandates target maximum active returns relative to tracking error volatility.

Our range of multi-asset strategies include absolute return and balanced mandates. These products are developed for institutional and retail investors who seek a product which is broadly diversified across asset classes including equities, listed property, conventional bonds, and inflation-linked bonds both domestically and internationally.

This collective investment scheme fund is managed with the objective of producing a real return of 4% above inflation per annum over the longer term while preserving capital over rolling 12-month periods. The Fund employs active asset allocation and derivative hedging to manage and reduce downside risk. It is broadly diversified across asset classes including equities, listed property, conventional bonds and inflation-linked bonds, both domestically and internationally.

The Fund is managed with the objective of producing a real return of CPI plus 4% per annum over the longer term while preserving capital over rolling 12-month periods. It may underperform relative to overall equity markets due to its focus on capital preservation and long-term capital growth.

These Regulation 28-compliant mandates aim to generate stable long-term returns through exposure to a broadly diversified set of asset classes including equities, listed property, conventional bonds, and inflation-linked bonds, both domestically and internationally. It is managed with the objective of producing a real return in excess of 5% per annum above inflation. Derivatives may be used for the purposes of hedging or return enhancement. The inclusion of international assets broadens diversification and should enhance risk adjusted returns.

This Fund aims to invest in a diversified combination of infrastructure risk-adjusted returns, whilst supporting the development of both social and economic infrastructure services. The Fund forms part of the Mergence suite of impact funds. The Fund strives to generate attractive risk-adjusted returns over that of the FTSE/JSE All Bond Index (ALBI).

These portfolios aim to consistently outperform the benchmark over a 12-month rolling period while providing liquidity at a low level of risk. These well-diversified portfolios implement a range of South African money market instruments.

This Fund aims to invest in a diversified combination of infrastructure risk-adjusted returns, whilst supporting the development of both social and economic infrastructure services. The Fund forms part of the Mergence suite of impact funds. The Fund strives to generate attractive risk-adjusted returns over that of the FTSE/JSE All Bond Index (ALBI).

Mergence is an independent asset management firm with a strong 18-year track record. We were founded in 2004 and have successfully grown our offering to a diverse product range across both public and private market investments, spanning specialist equity and fixed income, multi-asset, infrastructure, debt and private equity funds.

We are focused on sub-Saharan markets and led by a pragmatic, sustainable, shared value creation mindset. Responsible investing and ESG principles are part of our ethos and embedded across our investment processes.

Mergence is majority black-owned and managed and embraces the multi-cultural and multi-racial diversity of Southern Africa. We employ 58 people across our operations in Cape Town, Johannesburg, Windhoek, and Maseru.

At Mergence we value our people. Our culture is characterised by a collective focus on excellence and development, keeping our staff motivated and committed to growing with Mergence and growing our clients’ savings.

Our senior investment team have worked together for nearly a decade. With over 300 years of combined experience our entire team, including analysts and fund managers, have distinct specialisation in both Public and Private Markets. We leverage data and key elements from each area to widen our perspective and innovate to obtain outperformance.

Bachelor of Management Science (Finance)

MBA (Finance)

Masimo co-founded Mergence Africa Holdings in 2004 with the vision to create a world-class diversified group. With R42 billion in assets under management, the group spans asset management, derivatives trading, property, and industrial holdings. The primary subsidiary is Mergence Investment Managers, with a dual capability across Public and Private investment markets. Masimo is an entrepreneur by nature and believes fervently in “creating shared value”.

BCom (Accounting & Economics)

H.Dip.Ed

Fabian joined Mergence in 2006 with over 34 years’ experience in financial services, specialising in investment and macro strategy. Fabian’s primary focus is on investment risk, compliance and regulatory matters across Public and Private markets. He serves on the Mergence Board as well as the in-country Boards where Mergence operates. He has held senior and executive management positions at major SA banks and retirement funds.

MTech (Marketing)

BTech (Marketing)

Associate Financial Planner (AFP)

Certificate of Proficiency (Retirement Funding), Institute of Retirement Funds

Bongani joined Mergence Investment Managers in January 2009 in the Business Development team. He has 25 years of experience in the financial services industry, where he built an extensive network. His experience includes working as an institutional sales executive in employee benefits, and a manager in corporate social investment and transformation. Bongani sits on the Mergence Group executive committee.

BA (Political Science)

Executive MBA

Nyonga Fofang, Independent Non-Executive Director at Mergence, has 25+ years of capital markets experience, specialising in private equity, M&A, leveraged finance, and general management. He co-founded and leads Bambili Group Investment Pty Ltd, a pan-African investment holding company. Nyonga also serves as a director at SourceTrace LLC in Boston. He began as a closed-end fund Equity Analyst at PaineWebber Inc. and holds degrees from Harvard University and UC Louvain.

BCom (Accounting)

BCom Hons (Financial Planning)

MBA (Strategy)

CFP®

General Tax Professional (GTP-SA)

Semoli joined Mergence in 2017 as a regional investment strategist. He has 20 years’ experience, including as a fund accountant, investment consultant, and business development executive. With a strong network of contacts throughout the Southern African Development Community (SADC), he is also a non-executive director on several company boards. Semoli also serves on the executive committee of Mergence Investment Managers.

BSc (Chemistry)

BTech (Ceramic Science)

MSc (Engineering)

MBA (Administration)

Sholto joined Mergence in July 2022. He has more than 15 years’ experience in financial services with a focus on strategic leadership, product innovation, and research across all asset classes in Public and Private markets. He held various senior roles at the Public Investment Corporation including Acting Chief Investment Officer. Before entering the financial services sector, Sholto pursued a specialised career in resources and precious metals.

Diploma (HR Management & Training)

Karen joined Mergence in February 2014 as Office Manager. In December 2017, she was promoted to HR Manager. Karen has 27 years of experience in office management and finance, having worked at several large corporates before joining Mergence. In acknowledgement of the importance of our people, Karen was appointed to the executive committee of Mergence Investment Managers in October 2022.

BCom (Accounting)

PGDip (Accounting)

CA(SA)

John joined Mergence in November 2018 as General Manager: Operations. He was promoted to Chief Operating Officer in 2019. In September 2021 his role at Mergence was specialised into Chief Financial Officer as part of high-level changes to the Mergence executive leadership team to meet the company’s strong growth.

BCom Hons (Economics)

MCom (Economics)

MCom (Finance & Econometrics)

Peter joined Mergence in 2014 as a Senior Equity Investment Analyst specialising in the TMT sector. He became a portfolio manager in 2016 and head of the listed equities team in 2019. Peter has over 15 years’ experience in the financial services industry, having worked for several global investment banks. He won ABSIP equity analyst of the year in 2011 and has worked as a university lecturer in economics.

BAcc Hons

CA(SA)

BCom Hons (Financial Management)

In 2023, Salome re-joined Mergence as a Senior Investment Analyst, having worked in the company in a trainee capacity before. With a focus on the retail and industrial sectors, Salome brings valuable experience from previous roles at local asset managers and a global investment bank over an eight-year career in the financial services industry.

BCom (Financial Analysis & Portfolio Management)

MSc (Chemical Engineering)

Malose joined Mergence in 2022 as an Investment Analyst. With 20 years of experience, she has a solid background in chemical engineering and financial analysis. Malose previously worked as a process engineer at Sasol, Project Services Group, and Chevron. She also served as a sell-side equity research analyst at Primaresearch. Additionally, she has lectured in her field at the CPUT and provided consultation to 4th-year Design Course students at UCT.

BCom (Economics Science & Business Finance)

Radebe joined Mergence in March 2021 as Investment Analyst in the Public Markets equity team based in Johannesburg. He currently covers banks, insurance, and other financials. With five years of experience, Radebe has in-depth sector knowledge across SADC, most notably in the banking, precious metals, and telecom sectors. In 2017 he won the ABSIP award for Research Analyst of the Year.

BCom Hons (Finance/Investments), BCom (Economics and Finance)

Keagan Martin joined Mergence in 2021 as a Client Relationship Manager, following his experience at Prudential Investment Managers. In 2023, he transitioned into an Investment Analyst role in the public markets’ investment team, where he now specialises in small to mid-cap industrials and food producers.

BSc (Actuarial Science & Mathematical Statistics)

BSc Hons (Advanced Mathematics of Finance)

Exec Masters (Finance)

CFA® Charterholder

Mohamed joined Mergence in March 2021 as Head of Fixed Income: Multi-Asset Class. He has 14 years of experience. Mohamed is responsible for a stand-alone fixed-income product and integrating a fixed-income investment process into the overall multi-asset strategy. He is the primary portfolio manager for the Mergence Composite Bond Fund and lead investment manager for the Money Market and Multi-Asset Income portfolios.

BSc (Actuarial Science)

PGDip (Management in Actuarial Science)

Fazila joined Mergence in September 2020 as a Portfolio Manager in the Multi-Asset team. She has over 18 years of experience in the financial services industry, and a passion for research, technology, and sustainability. At Mergence, she is responsible for developing quantitative and systematic strategies across balanced and absolute return funds while also managing portable alpha strategies.

BCom Hons (Financial Analysis & Portfolio Management)

BSc Hons (Biotechnology)

Unathi joined the Mergence Public Markets Investment team in July 2020 as an Investment Analyst in the Multi-Asset team. She has ten years of asset management experience and is completing her BCom Master’s degree in Applied Finance at UCT. Her primary focus at Mergence is a top-down and bottom-up analysis of the South African property sector.

BSc Hons (Physics)

Thabiso Mgwambane joined the Mergence Public Markets Investment team in July 2023 as an Investment graduate. With a BSc Honors degree in Physics and currently pursuing a Master’s degree in Astrophysical Sciences, he brings advanced computational and mathematical programming skills, as well as proficiency in analytical and quantitative methodologies.

BSc (Mathematics & Statistics)

BSc Hons (Mathematics of Finance)

Financial Risk Manager (FRM)

MBA

Morgan joined Mergence in 2018. He has over 15 years of experience in the financial services industry. At Mergence, he has oversight on the generation and monitoring of investment risk metrics for Mergence portfolios including performance metrics, market risk, etc. In addition, he also has oversight on the compliance function pertaining to the Public Markets portfolios.

BCom (Economics, Risk, and Investment Management)

Jeandre joined Mergence in 2023 as an Investment Risk & Analytics analyst, bringing three years of industry experience. Notably, he honed his analytical skills and became the youngest team leader at Burgiss during his tenure as a Private Equity Data Analyst. His strength lies in working with databases and excelling at identifying errors and outliers through data manipulation.

BCom (Finance & Investment Management)

Nicolai joined Mergence 2019 as a Trader. He has 14 years of experience in financial services, both in London and Cape Town, including in equity dealing, client relationship management, hedge fund administration, and fund accounting. At Mergence, Nicolai is responsible for executing equity trades for the Public Markets team as well as managing broker relationships.

BSc Hons, MCom (Financial Management), ACCA

Chito joined Mergence in 2011 as an equity analyst in the public markets’ investment team focused on FMCG, hospitality, financial services, and telecommunications before transitioning to the private markets investment team in 2015. As Investment Principal, Chito focuses on private market investment opportunities within SADC. He has led transactions in the aquaculture and microfinance sectors and serves on the boards of several investment companies.

BBusSci Hons

Tshepiso joined Mergence in Johannesburg in 2018 following 11 years of experience in the deal team of a private equity house. At Mergence, Tshepiso has worked on deals in medicinal cannabis, primary healthcare, affordable housing, agri-finance, specialised healthcare, waste management, secondary mining, student accommodation, financial inclusion, and fintech spaces.

BCom (Investment Management and Banking), BCom Hons

Linkeng joined Mergence Investment Managers (Lesotho) in 2022 as a trainee analyst, where she supports the investment analyst team within private markets. Her role encompasses assisting with the origination of opportunities and guiding them through the investment process to implementation. Linkeng has team leadership skills, having been an SRC exco member at university.

BCom (Financial Accounting), PGDA, CA(SA)

Nandipha joined Mergence as a risk manager in the Private Markets investment team in June 2017. She has six years of experience working as an external and internal investment auditor. Nandipha’s responsibilities at Mergence include ensuring that governance, risk, and control frameworks are effective and that all investment activities, across all markets, sectors, and deals, are in accordance with applicable legislation, regulation, and client mandates.

BCom (Actuarial Science, Quantitative Finance)

BCom Hons (Finance)

MPhil (Development Finance)

CFA® Charterholder

Mosa joined Mergence in 2023 as a Senior Investment Associate in the Private Markets team. Previously, she worked at the International Finance Corporation, the Public Investment Corporation, and Momentum Metropolitan Holdings in various investment roles. She is also involved in lecturing and foundation trustee work.

BSc (Finance & Accounts)

PGDip (Accounting)

CA(SA)

Rizaan joined Mergence in 2022 as an Investment Associate. He is a trained investment professional with extensive post-qualification experience in investment banking, asset management, and renewable energy debt investment. He is responsible for the origination and execution of deals in the SADC region for Mergence’s Equity and Debt funds, with a focus on infrastructure finance, renewable energy, and other clean energy investment opportunities.

BCom Hons

Piwokuhle joined the Mergence Graduate Trainee Programme in July 2018. In 2020, she was appointed as Investment Analyst in the Private Markets investment team. She is involved in deal origination, due diligence, and post-investment monitoring. Piwokuhle has five years of experience in numerous industries in South Africa.

BBusSc

PGDip (Investment & Portfolio Management)

Hileni joined Mergence Unlisted Investment Managers (Namibia) as a Portfolio Manager in 2017. She has 15 years of experience in financial services. At Mergence she has transacted on and overseen infrastructure and impact investments on behalf of Namibia’s largest retirement fund, including three renewable energy projects, and a bulk infrastructure/land servicing project.

BCom (Economics & Finance)

BCom Hons (Financial Analysis & Portfolio Management)

CAIA Candidate

Veripi joined Mergence Unlisted Investment Managers (Namibia) as a Senior Investment Analyst in 2022. Prior to that, she gained experience as an unlisted Analyst at Temo Capital and held intern and trainee positions at EOS Capital and Simonis Storm stockbroking. Alongside her professional role, Veripi actively contributes as a budget coach, collaborating with Liberty Namibia on a financial literacy project.

BA (Economics)

PGDip (Property Management & Development)

MCom (Finance & Investments)

Ntsebeng joined Mergence Investment Managers (Lesotho) as a Property Analyst in 2022. She has five years of experience, including time spent as a real estate specialist and data analyst. Her responsibilities at Mergence include analysing the economic drivers of the commercial property portfolio and assessing the financial opportunity for existing and potential property investments.